Protiviti KnowledgeLeader

What Is Process Alignment Risk?

This is the risk that the business processes within a company may not be appropriately aligned with its corporate strategy, resulting in the inability of the organization to meet the demands of its customers efficiently and effectively. Process alignment can be defined as the synchronization of business process objectives and performance measures with organizational objectives and strategies, with a view to avoiding conflicting, uncoordinated activities.

Read More

Topics:

Risk Assessment,

Strategic Risk,

Knowledge Management

Fraud: Corporate fraud, employee theft, insurance scams/workers compensation fraud, employer fraud, forgery/falsified documents and even money laundering. Nobody likes to think it’s happening in their company, and yet global fraud studies by the Association of Certified Fraud Examiners (ACFE) estimate a median of 5% of revenue is lost every year due to fraud. While the ACFE found that both large and small organizations fall victim to occupational and workplace fraud, employee theft and financial fraud are especially detrimental to businesses with less than 100 employees.

Read More

Topics:

Fraud,

Ethics,

Internal Controls,

Segregation of Duties

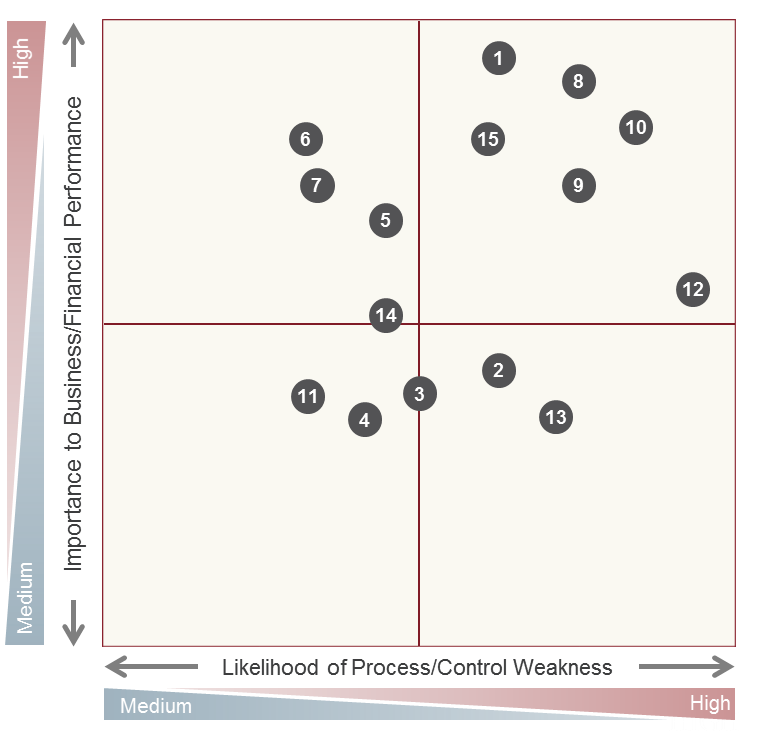

Risk assessment helps identify and document critical business processes and the internal controls within each process. Combined with facilitated management meetings, this approach can help gain company-wide consensus by including key process owners in risk and controls analysis.

Read More

Topics:

Enterprise Risk Management,

Risk Assessment,

Governance, Risk & Compliance

Good process documentation doesn’t just describe how things work—it tells a story of an organization’s modus operandi (MO). As with any storytelling, it’s possible you might sit down to document your process and encounter writer’s block. There it is, the dreaded blank page taunting you as you struggle to decide how to get started.

Read More

Topics:

Internal Audit,

Process-Level Control,

Document Retention

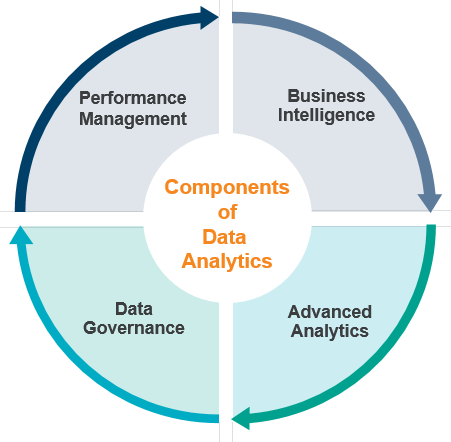

What is Data Analytics?

Data analytics is the practice of embedding insight into operations to drive business strategy and performance.

Read More

Topics:

IT Audit,

Data Analytics

Self-assessment is a process through which an organization utilizes its internal knowledge to identify and assess uncertainties and the extent to which current practices are sufficient and appropriate to manage and achieve strategic objectives. Self-assessment drives the "tone at the top" down to process owners.

Read More

Topics:

Internal Audit,

Internal Controls,

Entity-Level Control,

Self-Assessment

As a result of the infamous Enron and WorldCom scandals, the U.S. reacted with strict guidelines to re-establish confidence in the financial market. Commonly referred to as the Sarbanes-Oxley Act, or “SOX,” the Public Company Accounting Reform and Investor Protection Act of 2002 was implemented to protect shareholders and the general public from fraud and general accounting errors. SOX has come to be considered part of the total fabric driving reliable financial reporting, impacted by securities laws and regulatory oversight, exchange listing requirements, accepted accounting principles, effective auditing standards, accounting firm oversight, effective standards for audit committees of boards, and independence requirements for directors and auditors, among other things.

Read More

Topics:

Internal Controls,

PCAOB

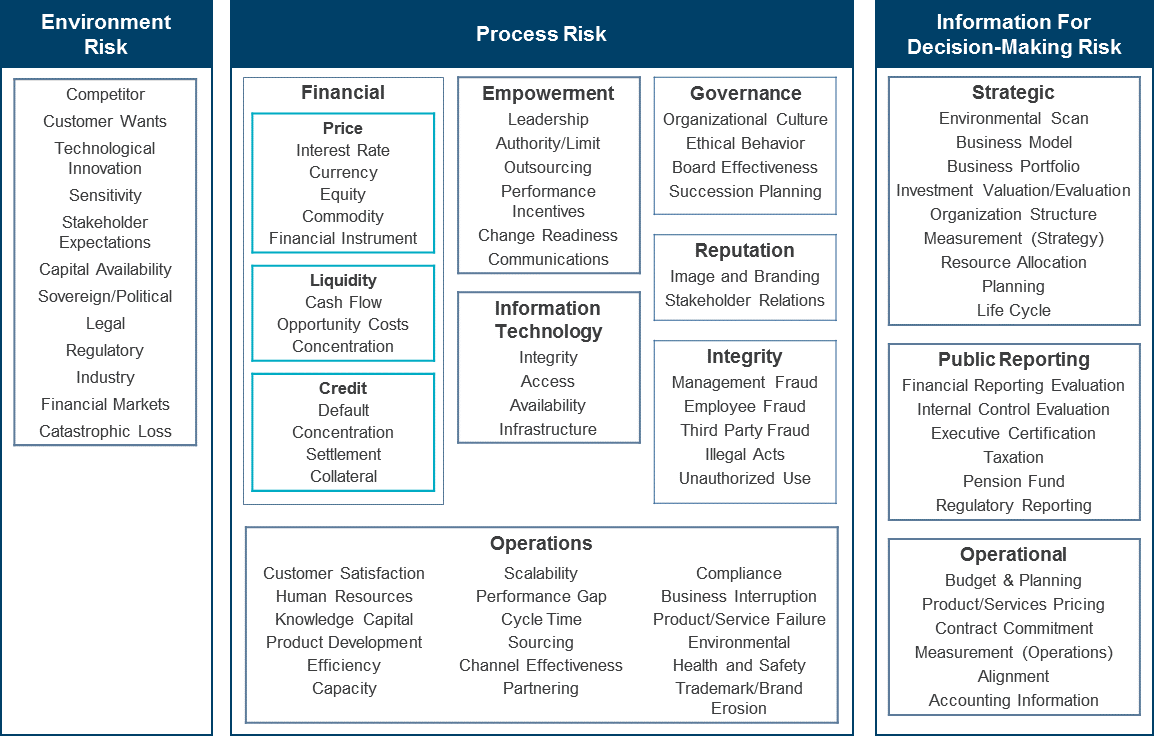

Business risk is the level of exposure to uncertainties that the enterprise must understand and effectively manage as it achieves its objectives and creates value. It is not just about threats; there is an upside as well as a downside. Risk is not about a single point estimate—time frame is an important factor when evaluating risk, and exposure and uncertainty are important factors.

Read More

Topics:

Risk Assessment,

Governance, Risk & Compliance,

Strategic Risk

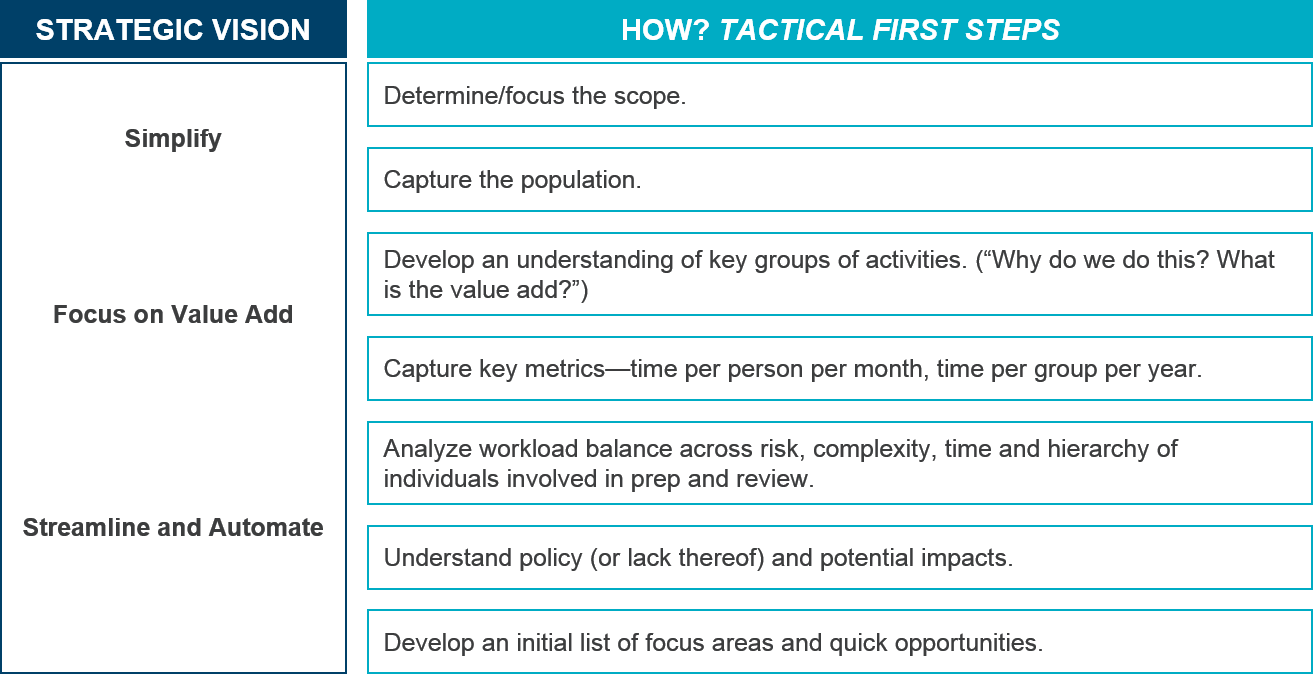

Most organizations continue to invest a significant number of hours every month in a particular set of activities related to calculating, manipulating and validating critical financial reporting data using spreadsheets. Organizations should be asking whether this level of effort represents incremental value to the financial reporting process and whether this actually does needs to be done in spreadsheets.

Read More

Topics:

Accounting/Finance,

Financial Reporting,

Close the Books

It seems like everybody is wearing a lot more hats these days and finance leaders are no exception. Of course, this means that they are finding it increasingly difficult to balance the multitude of responsibilities and non-routine initiatives facing the finance function.

Read More

Topics:

Project Management,

Accounting/Finance,

Change Management