A fast, close-the-books process provides multiple benefits for the finance function and for the company. First, a fast close process creates more time for finance professionals to focus on strategic activities for the company, such as identifying warnings in financial data and providing the corporation's financial direction. It also reduces the cost of the finance function, since fewer hours are needed to close the books. And it demonstrates that the company's controls and systems are well organized; the company sends the message to its competitors and to the investment community that it is expert at performing business processes.

Protiviti KnowledgeLeader

Recent Posts

Close-the-Books Guide: Reduce Financial Close Risk

Topics: Risk Assessment, Accounting/Finance, Financial Reporting, Close the Books

Inventory Management Sample Process Interview Questions

This extensive list of questions can be asked during an interview for an inventory audit.

Topics: Supply Chain, Vendor Management, Accounting/Finance, Inventory & Materials Management

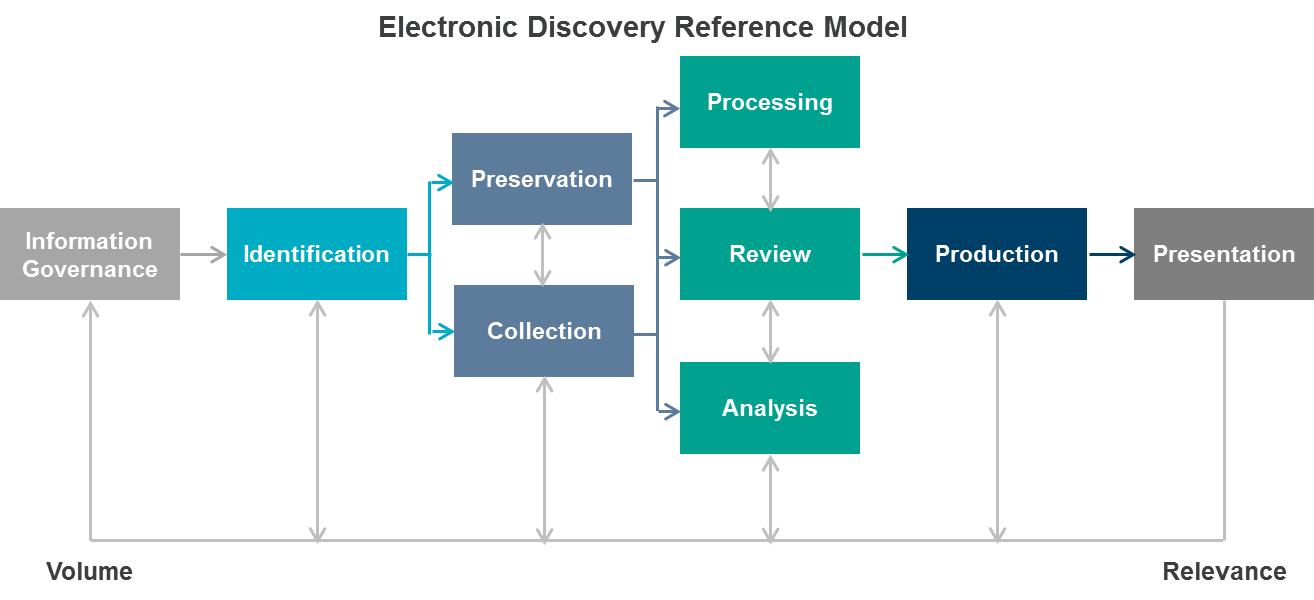

Electronic Discovery Risks, Challenges and Procedures

Electronic discovery (eDiscovery) refers to the process of searching, locating and securing electronic data for the purpose of using it as evidence in a legal case.

Topics: Laws & Regulations, IT Audit, IT Security, IT Controls, Investigations/Forensics

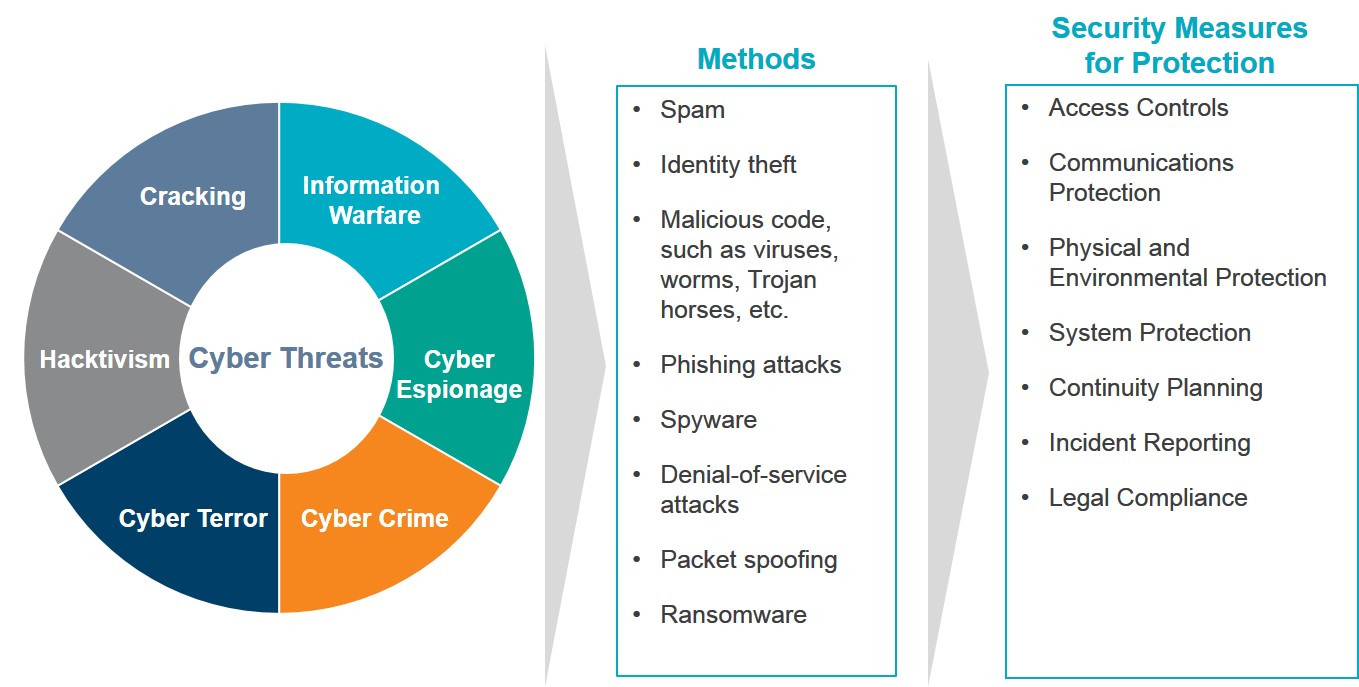

What Is Internal Audit’s Role in Cyber Security?

Corporations today are thinking about how to protect assets. A few of the white collar crime problems include hacking/intrusions (cyber vulnerability), insider/outsider trading (convergence of cyber and financial crimes), the Foreign Corrupt Practices Act (FCPA), spear fishing (email compromise) and economic espionage. They must consider the possibility of internal corruption or external corruption, and environmental factors such as culture and competition contributing to these crimes. As protection, organizations can use cyber security, pen testing and data loss prevention tactics.

Topics: Enterprise Risk Management, Internal Audit, Internal Controls, Risk Assessment, Cybersecurity, IT Controls

How to Mitigate Risks Using Effective Business Continuity Planning

Thorough business continuity plans help organizations minimize the risks of a disaster and restore vital business functions without significant detrimental effects. This blog post examines the fundamentals of business continuity management (BCM) planning and highlights critical lessons learned from various recent disasters, providing actionable steps you can take to create a customized plan.

Topics: Risk Assessment, Governance, Risk & Compliance, Strategic Risk, Business Continuity Management, Self-Assessment, Performance Management/Measurement

What is Design Risk and the Risks Associated with System Design?

To “design” is to create, fashion, execute, or construct according to plan. The term design as used here refers to the entire scope of a project. A business system design is a collection of design documents and supporting materials, which define the system functionality that supports one or more business processes and in the process, creates, retrieves, updates, and deletes data.

Risks Associated with Data Integrity and Management Best Practices

Failure to manage data integrity risk can have the following impact:

Add a Comment: