Is The Treasury Function Ensuring Superior Financial Services for Your Company?

The treasury function at a company bears responsibility for managing financial transactions, safeguarding deposits, earning a return on reserves and obtaining credit. At a minimum, the staff of the treasury function selects and supervises providers of financial services, such as bankers and lenders, who will produce superior results at a fair price. In companies that apply leading practices, the treasury function staff develops relationships with bankers and lenders who provide more than simple banker-to-customer services: the relationships progress into collaborative business partnerships where the bankers help the company manage financial risk and develop the resources worldwide to meet its strategic financial objectives.

Read More

Topics:

Accounting/Finance,

Cash & Treasury,

Performance Management/Measurement,

Credit & Collections

Key Performance Measures Improving the Process

An effective business process is built on a set of well-defined and clearly-stated business objectives. These key objectives articulate the ideal performance results that the company expects from that process. To monitor a business process so that it stays focused on reaching the key objectives, the company chooses appropriate performance measures. In fact, careful selection of the performance measures takes a company a long way toward improving a business process. Thus, to build and then continually improve an effective business process, a company establishes:

Read More

Topics:

Laws & Regulations,

Accounting/Finance,

Financial Reporting,

Performance Management/Measurement

In recent blog posts, we’ve discussed KPIs for various processes and even gave a concise description of what they are (see Guide to Managing Mergers and Acquisitions KPIs). In this post, we’ll be looking at KPIs again and this time it’s for Accounts Receivable (AR), Credit and Collections and we have a great document on KnowledgeLeader that goes more in-depth.

Read More

Topics:

Accounting/Finance,

Accounts Receivable,

Cash & Treasury,

Performance Management/Measurement,

Credit & Collections

Few things can be as fraught with stress and complication for top executives and business owners as evaluating mergers and acquisitions. Some mergers are consummated to capitalize on new geographic or demographic markets, expand product offerings, facilitate the acquisition of key employees, boost productivity, reduce competition by absorbing a rival company, or even more long term strategies. Whatever the reason, the process and outcome must be measured to determine if it was successful in meeting business objectives.

Read More

Topics:

Initial Public Offering,

Accounting/Finance,

Performance Management/Measurement,

Mergers and Acquisitions

Budgeting is a systematic process for:

- Expressing future plans in formal quantitative terms

- Allocating resources to achieve strategic goals

- Monitoring progress toward goals

- Controlling spending

- Predicting cash flow and profits

- Serving as a vehicle for communicating plans in an orderly manner throughout the organization

Read More

Topics:

Audit Planning,

Accounting/Finance,

Budgeting

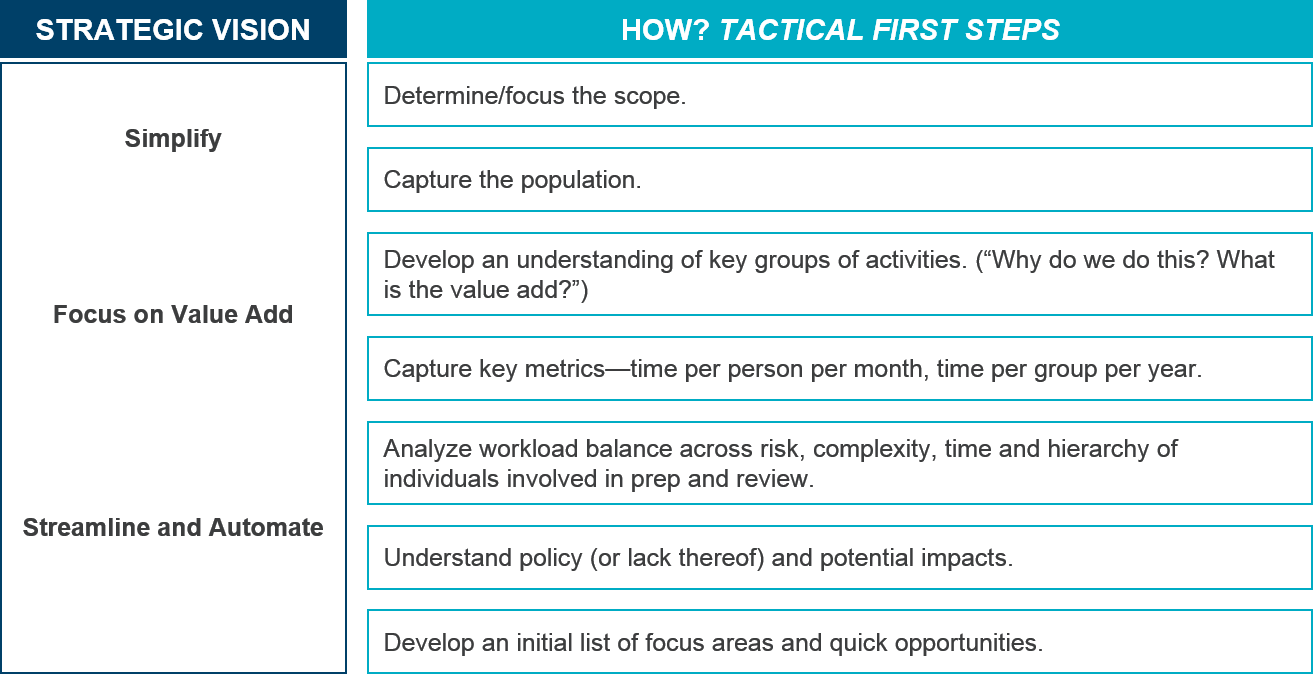

Most organizations continue to invest a significant number of hours every month in a particular set of activities related to calculating, manipulating and validating critical financial reporting data using spreadsheets. Organizations should be asking whether this level of effort represents incremental value to the financial reporting process and whether this actually does needs to be done in spreadsheets.

Read More

Topics:

Accounting/Finance,

Financial Reporting,

Close the Books

It seems like everybody is wearing a lot more hats these days and finance leaders are no exception. Of course, this means that they are finding it increasingly difficult to balance the multitude of responsibilities and non-routine initiatives facing the finance function.

Read More

Topics:

Project Management,

Accounting/Finance,

Change Management

A fast, close-the-books process provides multiple benefits for the finance function and for the company. First, a fast close process creates more time for finance professionals to focus on strategic activities for the company, such as identifying warnings in financial data and providing the corporation's financial direction. It also reduces the cost of the finance function, since fewer hours are needed to close the books. And it demonstrates that the company's controls and systems are well organized; the company sends the message to its competitors and to the investment community that it is expert at performing business processes.

Read More

Topics:

Risk Assessment,

Accounting/Finance,

Financial Reporting,

Close the Books