A fast, close-the-books process provides multiple benefits for the finance function and for the company. First, a fast close process creates more time for finance professionals to focus on strategic activities for the company, such as identifying warnings in financial data and providing the corporation's financial direction. It also reduces the cost of the finance function, since fewer hours are needed to close the books. And it demonstrates that the company's controls and systems are well organized; the company sends the message to its competitors and to the investment community that it is expert at performing business processes.

Close-the-Books Guide: Reduce Financial Close Risk

Topics: Risk Assessment, Accounting/Finance, Financial Reporting, Close the Books

Inventory Management Sample Process Interview Questions

This extensive list of questions can be asked during an interview for an inventory audit.

Topics: Supply Chain, Vendor Management, Accounting/Finance, Inventory & Materials Management

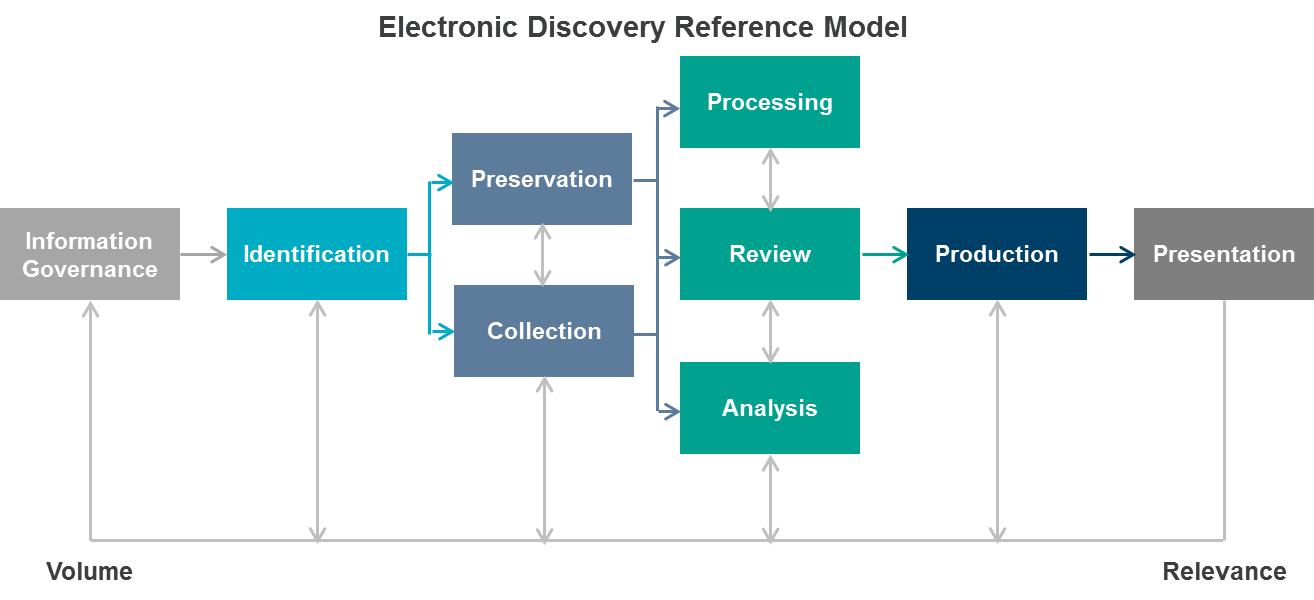

Electronic Discovery Risks, Challenges and Procedures

Electronic discovery (eDiscovery) refers to the process of searching, locating and securing electronic data for the purpose of using it as evidence in a legal case.

Topics: Laws & Regulations, IT Audit, IT Security, IT Controls, Investigations/Forensics

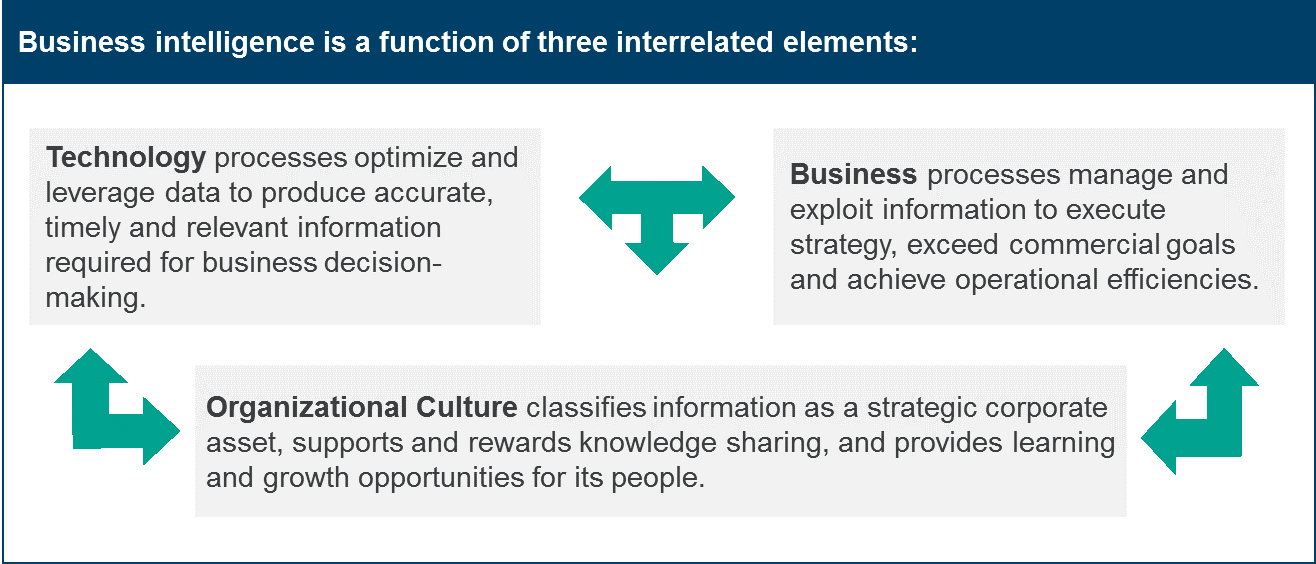

Signs That Your Organization Needs Business Intelligence Solutions

|Busi*ness In*tel”li*gence|, n. - the capacity to acquire and apply business knowledge, the act or state of knowing about your business; to understand and profit from experience; the internal development and sharing of information to create a competitive advantage.

Topics: IT Strategy, Data Analytics

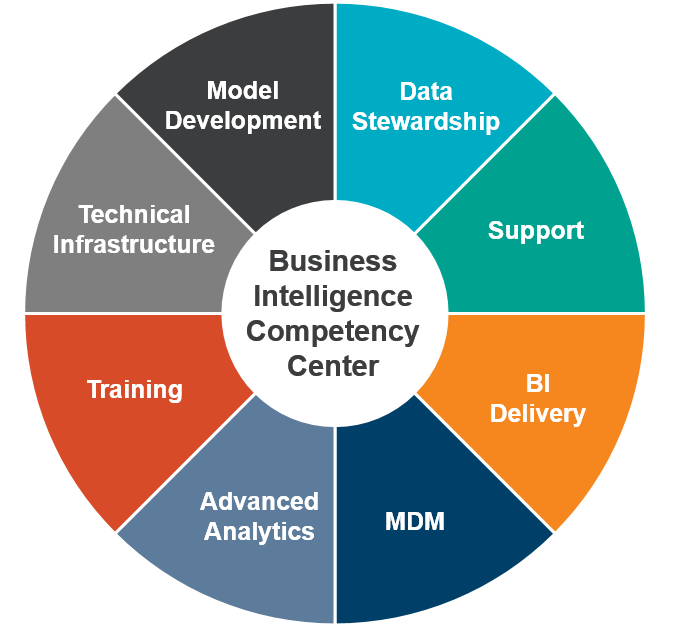

Business Intelligence Competency Centers Overview and Guide

The objectives of a business intelligence competency center (BICC) are to provide the organization with better control over operational and financial reporting, reduce reporting costs, improve consistency, and provide the organization with more complete information for management decisions. BICCs are often business-led cross-functional teams that provide organizational support and guidance for implementation and usage of business intelligence processes and technology. They can live within the IT organization, but more often are business driven.

Topics: IT Strategy, Data Analytics

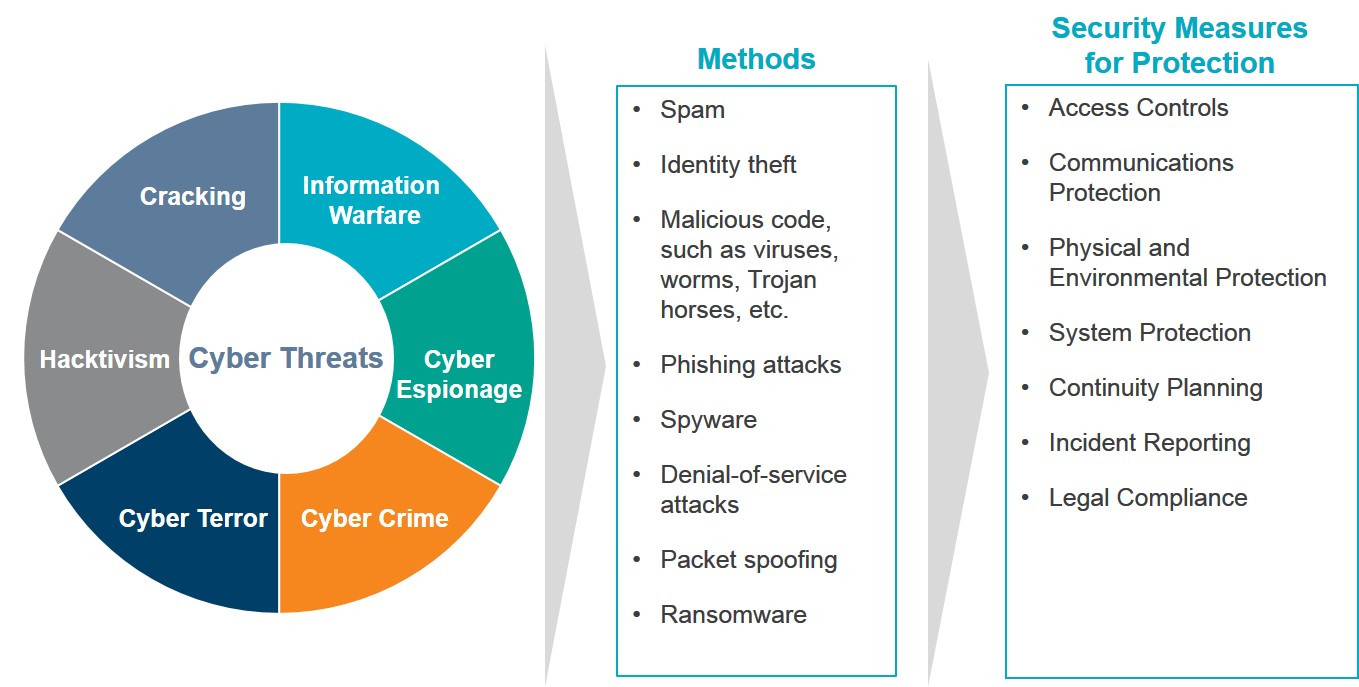

What Is Internal Audit’s Role in Cyber Security?

Corporations today are thinking about how to protect assets. A few of the white collar crime problems include hacking/intrusions (cyber vulnerability), insider/outsider trading (convergence of cyber and financial crimes), the Foreign Corrupt Practices Act (FCPA), spear fishing (email compromise) and economic espionage. They must consider the possibility of internal corruption or external corruption, and environmental factors such as culture and competition contributing to these crimes. As protection, organizations can use cyber security, pen testing and data loss prevention tactics.

Topics: Enterprise Risk Management, Internal Audit, Internal Controls, Risk Assessment, Cybersecurity, IT Controls

Free CPE Webinars on AuditNet for KnowledgeLeader Subscribers

Everybody loves convenient ways to get CPE credits. Luckily, KnowledgeLeader subscribers have yet another way to keep the end-of-year CPE stress to a minimum!

How Useful Are Data Analytics in the Audit Process?

Internal audit has started the journey toward enabling analytics in audit processes, but there’s a long road ahead. This report explains why through the key findings of Protiviti’s 2017 Internal Audit Capabilities and Needs Survey. In a digital world, now is the time for internal audit functions to embrace analytics. The results of this 2017 survey are the most significant takeaway, which shows that chief audit executives (CAEs) and internal audit professionals increasingly are leveraging analytics in the audit process, as well as for a host of continuous auditing and monitoring activities.

Topics: Internal Audit, Continuous Auditing, Data Analytics

COSO ERM Framework: Key Facts You Need to Know

When initiating the project to update its ERM framework, COSO saw opportunities to achieve clarity on several fronts. The updated framework recognizes the increasing importance of the interconnection of risk, strategy and enterprise performance – particularly in conjunction with making important decisions. It begins with an underlying premise that every entity exists to provide value to its stakeholders and faces uncertainty in the pursuit of that value. Therefore, the framework itself focuses on preserving and creating enterprise value, with an emphasis on managing risk within the entity’s risk appetite. The term “uncertainty” is defined as not knowing how or if potential events may manifest themselves in the context of achieving future strategies and business objectives. “Risk” is considered the effect of such uncertainty in the formulation and execution of the business strategy and the achievement of business objectives.

Topics: Enterprise Risk Management

How to Define Risk Management Goals and Objectives in Your Organization

Risk oversight and risk management are high priorities on the agenda of most organizations. Here are popular KnowledgeLeader tools that focus on risk management:

Topics: Enterprise Risk Management

Add a Comment: